Mid-Year Check-In: How Our Industrial Transformation Predictions Are Playing Out

08 Aug, 2025

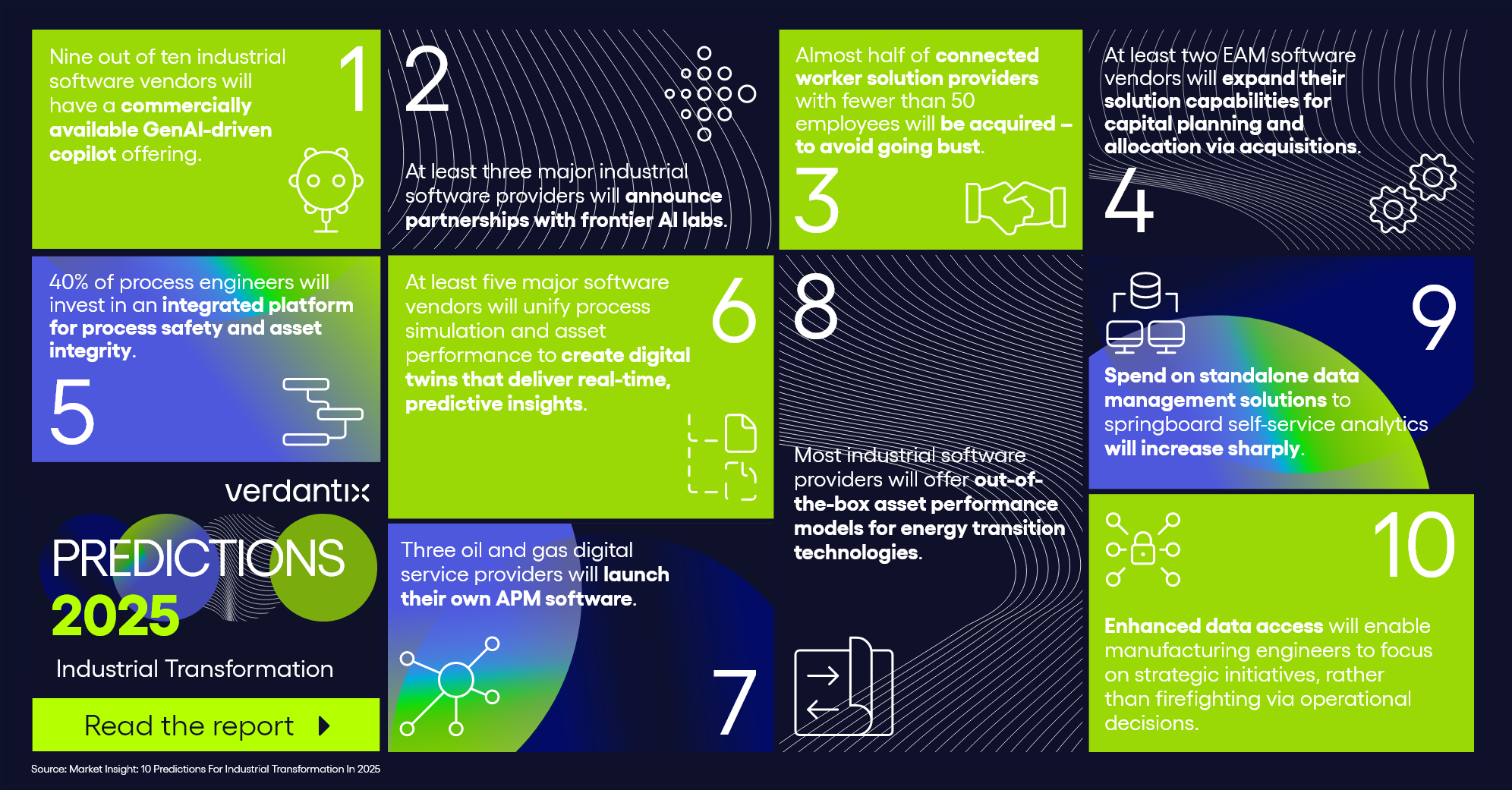

Having passed the mid-point of 2025, it’s time to check in on our industrial transformation predictions and see how they’ve unfolded. GenAI has dominated the headlines this year, alongside the rise of model context protocol (MCP) adoption. But not all trends are moving at the same pace, with some taking longer to play out than expected.

- One we got right: Nine out of 10 industrial software vendors will have a commercially available GenAI-driven copilot offering.

As predicted, the majority of industrial software vendors have released GenAI-driven offerings. Two main approaches have emerged: the first allows free text user prompts, like ChatGPT; the second focuses on providing guided workflows and agents. Both aim to collect and contextualize asset information, build dashboards and provide recommendations. Adoption of AI agents is growing; initial success in use cases such as root cause analysis (RCA) has driven the development of predictive and prescriptive agents. To harness their value, organizations need more effective management processes, autonomy and capabilities across multiple agents. This need is reflected in the increasing adoption of MCP by vendors throughout the year. - One that’s emerged rapidly in the last six months: Rise in MCP adoption.

To fully harness the potential of AI agents, they need to be able to securely access and interpret data from multiple industrial assets and systems, to provide the required contextualization. Vendors have been adopting the MCP developed by Anthropic in late 2024 – an open standard enabling secure connections between data sources and AI-powered tools. Initially, vendors have focused on developing MCP wrappers to provide agents with access to industrial data through APIs. They are also investing in MCP-compatible architecture and more native MCP implementations. These investments will empower more capable multi-agent automated workflows. - One that will take longer than initially predicted: At least two EAM software vendors will expand their solution capabilities for capital allocation planning via acquisitions.

Customers continue to seek integrated platforms that combine asset health insights with capabilities to support long-term investment planning. Some vendors have expanded their offerings, as seen in the acquisition of Copperleaf by IFS in 2024, suggesting that others might follow suit. While outright acquisitions of asset investment planning (AIP) software providers have been limited, industrial software vendors are expanding their capabilities for capital allocation planning through partnerships with specialist AIP software providers, or by building capabilities in-house, thereby extending commercialization timelines.

For more information, read our 10 Predictions for Industrial Transformation report here.

Discover more Industrial Analytics & Data Management content

See More

About The Author

Jatinder Devgun

Senior Analyst