How PSM Buyers Are Rewriting Vendor Priorities

Industrial firms are rethinking their approach to process safety management (PSM) software. The Verdantix global survey of senior professionals reveals how buyers perceive leading PSM vendors, where they are directing spending, and which initiatives are climbing the priority list. The findings point to a market in transition, with digital transformation propelling investment decisions and reshaping operational priorities.

In an analysis based on insights from the global survey, Sphera comes out on top for brand perception, driven by its strong recognition in high‑risk sectors and established position in process safety. VelocityEHS leads on brand awareness, supported by its broad product footprint and visibility across EHSQ and operational risk. These results underline how reputation and visibility shape decision‑making in a market where buyers weigh trust, innovation and integration capability alongside core functionality. It naturally raises the question of what drives these perceptions and how vendors can influence them.

Positioning matters, and leading firms are already putting more deliberate thought into how they present their capabilities and domain expertise. Vendors looking to hone their approach should consider:

- Tailoring messaging to industry-specific risk profiles and regulatory pressures

- Communicating AI capabilities with clarity and relevance

- Building buyer trust through transparent data governance and safety assurance

Investment plans for the next 12 months show strong momentum. Verdantix forecasts that the PSM software market will grow from $1.45 billion in 2024 to $3.07 billion by 2030 – at a CAGR of 13.3% – reflecting sustained investment even as budgets tighten elsewhere. Most firms expect to maintain or increase spending on PSM software, with particular interest in solutions for Control of Work and process hazard analysis. In this competitive landscape, how vendors articulate value, capability and domain credibility continues to shape buying preferences. Those that align clearly with operational needs are better placed to win new business.

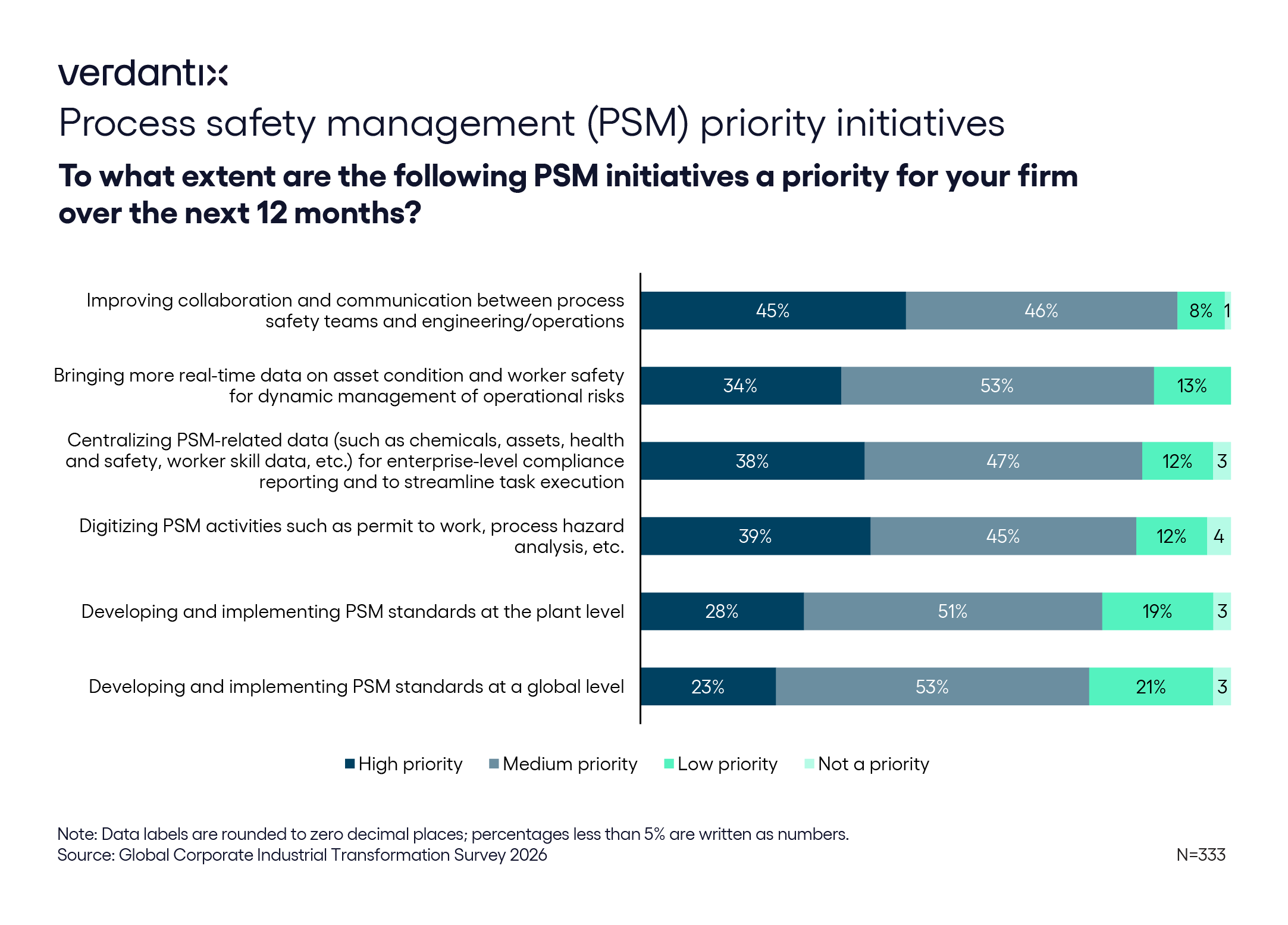

Yet despite rising investment, many organizations still rely on spreadsheets and in-house systems for core safety processes such as isolation management and job hazard analysis. The adoption of commercial software is growing, but far from universal. Improving collaboration between safety and operations teams tops the list of priorities for 2026, alongside digitizing PSM activities and centralizing compliance data. Firms are also increasingly integrating real-time risk insights into frontline decision-making. These priorities reflect a broader push towards connected safety ecosystems, where data move freely across teams and support more proactive risk management.

This gap in software adoption provides an opportunity for vendors to help firms transition to integrated, automated solutions that improve efficiency and reduce risk. One such example is Prometheus Group’s acquisition of NiSoft in December 2025, which expanded its digital Control of Work and process safety capabilities, offering firms a clearer path away from manual processes.

The message is clear: process safety leaders are committed to modernization, but progress varies widely. Vendors that align with buyer priorities, communicate value clearly and support digital integration will be best positioned to succeed in the year ahead.

For more detailed findings, read the full global survey: Global Corporate Survey 2026: Industrial Transformation Budgets, Priorities And Tech Preferences. To understand how individual providers stack up, read Market Perception Trends: Process Safety Management Software Providers (2025).

About The Author

Oliver Bridges

Analyst