Torn In Two: Regulatory Divergence In Europe And The US

Firms operating on both sides of the Atlantic will face two increasingly divergent regulatory trends in 2026. In Europe, authorities will continue to roll out new regulations, while in the US, Trump is expected to accelerate deregulation efforts for as long as he maintains support from Congress. Those organizations caught in this crossfire will need to make a tough call: either follow European standards or give up their interest in the EU to take full advantage of Trump’s deregulated environment.

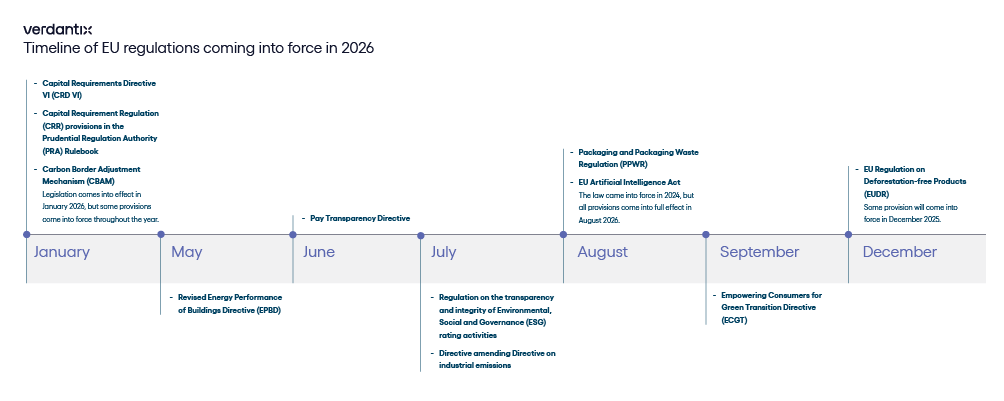

The European regulatory outlook for 2026 will see a significant volume of directives and legislation come into force, imposing new obligations and restrictions across multiple industries (see below). These changes have been in the pipeline for several years and should not come as a surprise to those selling, servicing or operating in Europe.

In the US, President Trump has adopted an aggressive deregulation agenda, carried out through executive orders, new legislation and efforts to downsize the federal government. What’s more, the pace of deregulation is likely to accelerate substantially in 2026. The results of US elections in November 2025, indicate that Democrats are likely to take full or partial control of Congress during next year’s mid-term elections. If this plays out, Trump will struggle to pass any legislature in 2027, creating urgency to step up the deregulatory agenda now.

Against this background, organizations operating in Europe and the US will face a catch-22 dilemma: align with one approach over the other at their own peril. While regulatory divergence is more manageable if firms can operate on a siloed capacity by jurisdiction, this separation is not easy to achieve. The cost of adjusting production for one of the markets could come at the expense of efficiency, price competitiveness and market share.

Additionally, firms should avoid a siloed approach when it comes to GRC, as a blinkered view of risk management exacerbates risk by generating blind spots, while increasing costs and duplicating efforts (see Verdantix When The Guardrails Come Off: The New Risk Leadership Challenge). This means that the standards set by European regulations will have to be implemented consistently across the entire organization if it wishes to continue to operate in the European market. Trump’s deregulatory push becomes an arbitrage factor, benefitting in the short term those firms selling in the US only at the expense of those who seek to serve the two markets.

Some organizations might be tempted to embrace Trump’s regulation-less environment and focus solely on the US market. But history has taught us that large-scale rollbacks tend to be followed by a regulatory tsunami a few years later, with examples spanning from the Great Depression to the 2008 global financial crisis. Decision-makers should, therefore, consider the long-term implications of rejecting European regulatory standards – or they risk being ill-prepared when the regulation tide comes back in.

For more risk management content, check out Verdantix insights, and to learn more about how to navigate the intersections between risk, regulations and safety, register to attend the Verdantix Transform event in Amsterdam in March 2026.

About The Author

Luis Nino

Principal Analyst